About Us

Our Portfolio

Investors

Sustainability

Media

We are delighted to share our Annual Report and Accounts 2025 following a year of transformation and growth.

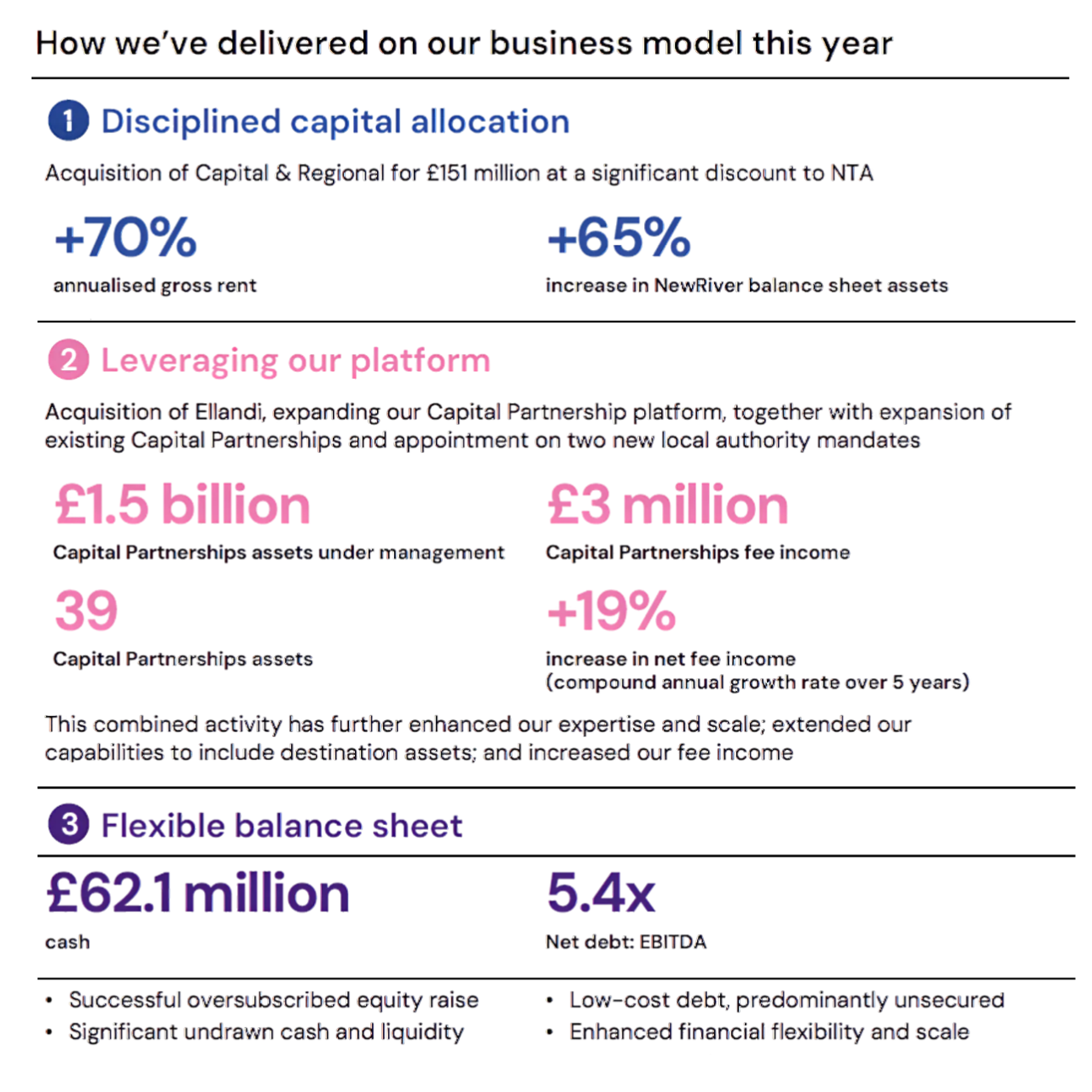

In December 2024 we completed a major corporate transaction to acquire listed retail real estate company Capital & Regional plc for £151 million, funded through a combination of cash and shares, following a successful and oversubscribed equity raise.

The acquisition increased the scale of our portfolio through the combination of six complementary shopping centres with a similarly low-risk tenant profile and strong income growth potential.

The Capital & Regional assets are performing well, with integration and synergies on track following the acquisition.

Our 2025 Annual Report showcases this growth and how our people, portfolio and partnerships are driving our performance.

Enhanced equity profile with greater share liquidity, a broader shareholder base and larger weightings in key indices.

Balance sheet assets increase vs FY24

UFFO increase vs FY24

Annualised gross rent vs FY24

Cost synergies expected to be fully unlocked on an annualised basis within 12 months of completion1

Robust capital structure maintained average cost of debt with improved maturity profile

Teens expected to deliver accretion to UFFO per share

"The acquisition of Capital & Regional has been transformational for the business and sets a strong platform for further growth.”

Allan Lockhart

Chief Executive

“We believe the success of our equity placing as reflective of increased investor confidence in NewRiver, the attractiveness of the Capital & Regional transaction and a recognition that our marketplace has been improving.”

Lynn Fordham

Chair

“The acquisition of Capital & Regional materially increased our scale and has already benefitted UFFO per share and our dividend.”

Will Hobman

Chief Financial Officer

Our strategy is delivered by our People, Portfolio, Partnerships and Performance

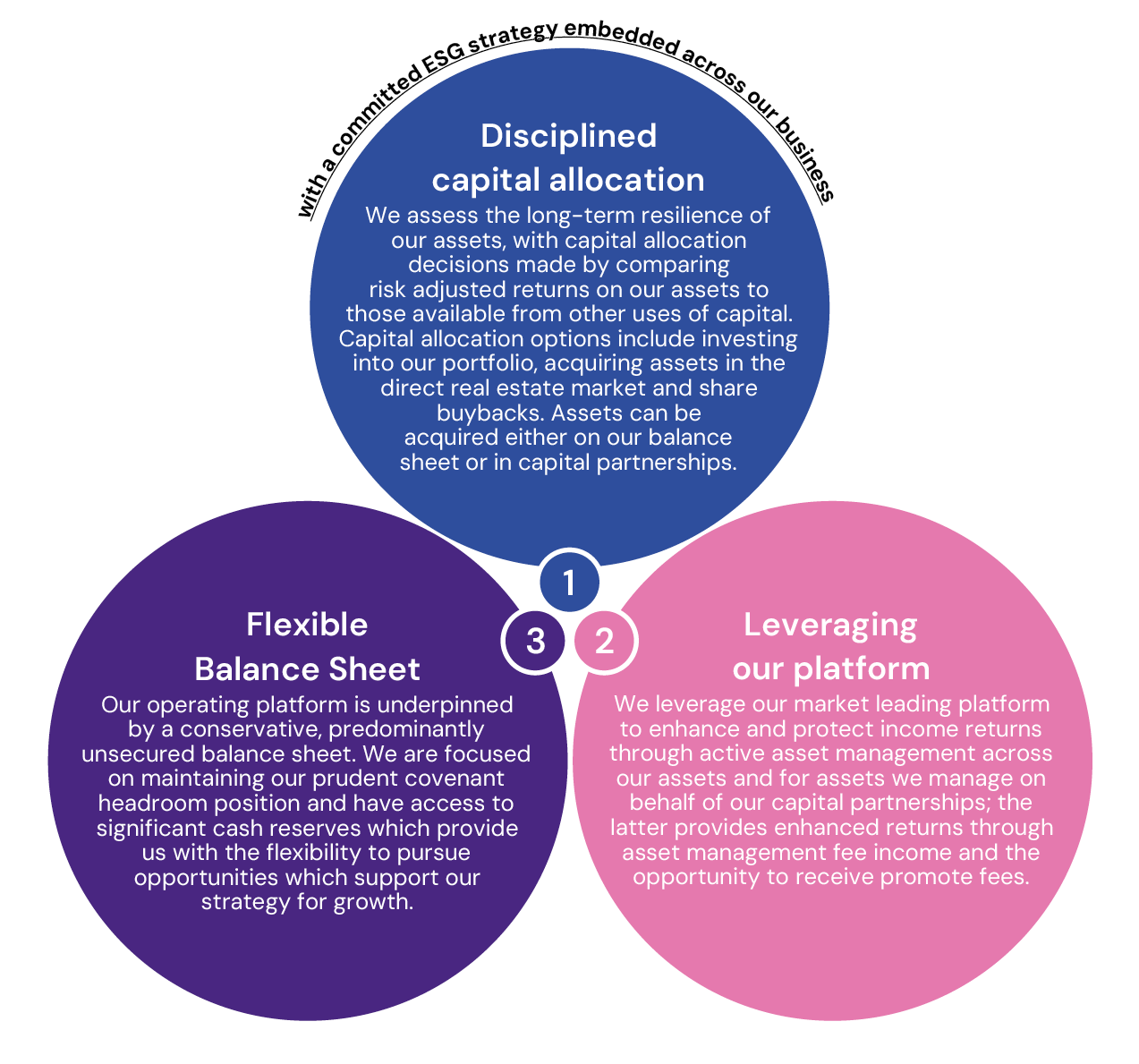

Our business model is underpinned by a high-quality portfolio, expert team, strong working relationships, data-driven insight, robust systems and a commitment to sustainability to support the delivery of positive performance for the long-term.

Strong financial position

Underlying Funds From Operations (UFFO)

UFFO per share

IFRS profit / (loss)

Dividend per share

Portfolio valuation performance6

EPRA4 NTA per share1

Loan to Value (as at 31 March 2025 prior to Abbey Centre disposal)

Total accounting return1

High-quality, affordable portfolio3

Occupancy2

Retention

Total Property Return

In store sales growth accounting for online spend contribution (YoY, Lloyds Bank data)5

Average rent, per sq ft

Occupational Cost Ratio

Long-term transactions vs previous rent

Long-term transactions vs ERV

Our growth is delivered by a high-quality portfolio, strong working, relationships and data-driven insight.

Our people, partnerships and portfolio help drive our performance – focused on delivering attractive, reliable and growing returns and creating thriving communities.

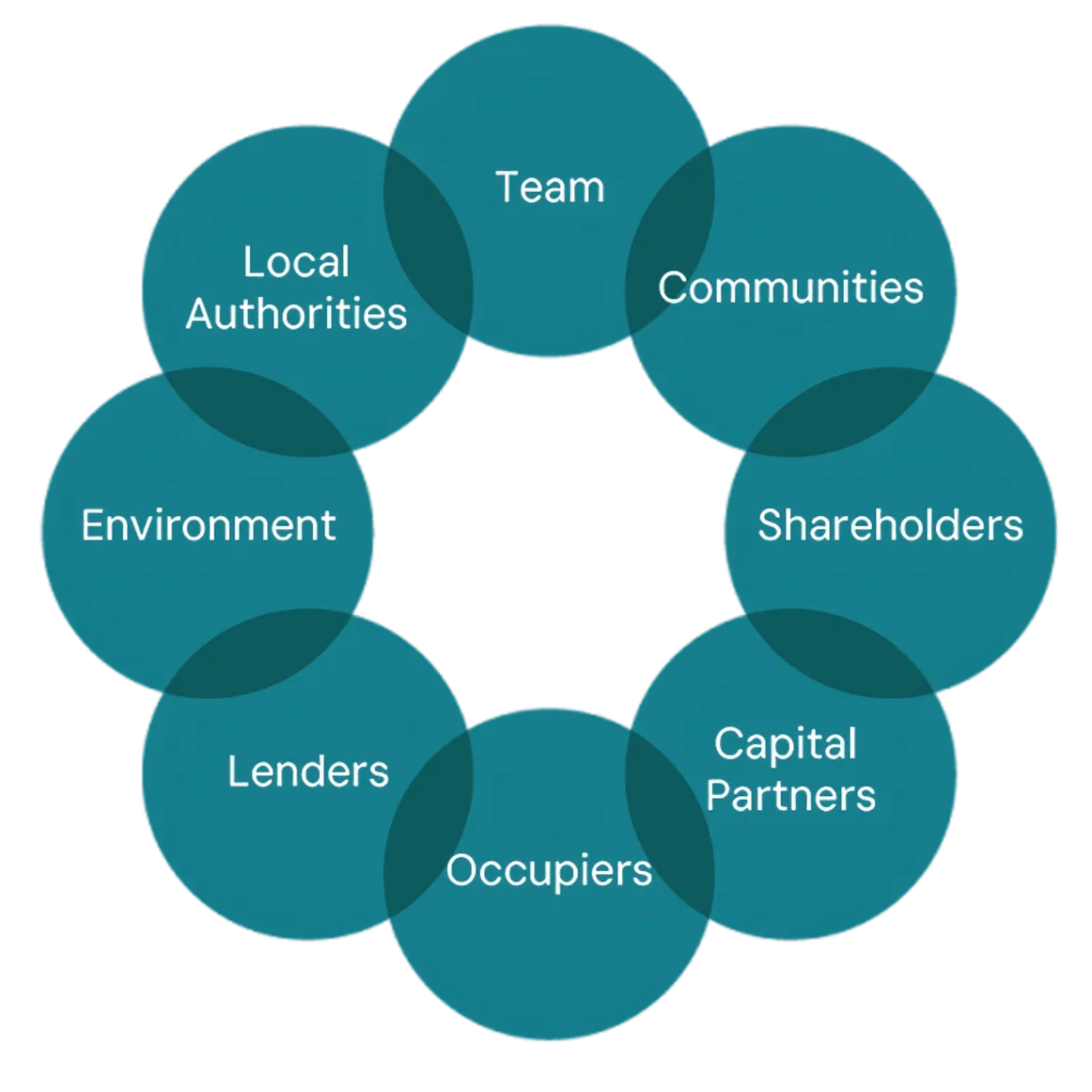

Our Stakeholders

In what has been a transformational year for NewRiver, we have continuously focused on the impact and outcome for each of the various stakeholders across our business. We recognise that our long-term success is founded on strong and transparent two-way relationships with our stakeholders, and understanding the evolving needs and expectations of each.

Board engagement

Critical to effective Corporate Governance is how the Board aligns strategic decisions with the Company’s purpose, values, strategy and stakeholders. The NewRiver Board has a clear stakeholder engagement plan, regularly consulting with the NewRiver Executive Directors and wider team, who in turn manage and foster the relationships with core stakeholders.

Our Stakeholders include

Progress towards our objectives is measured annually against our ESG targets and external benchmarks, and the outcomes are used to enhance our ESG activities for the following year. This approach generates a feedback loop whereby our ESG programme adapts to the findings and the evolution of best practice.

Minimising our environmental impact requires action at the corporate, portfolio, and asset level. Our net-zero pathway and interim targets guide our initiatives, supported by our asset-level Environmental & Social Implementation Plans, which allow us to monitor our progress and accelerate action where required.

Top 3 Achievements in FY25

We are committed to ensuring that we are responsible partners in our communities, supporting and championing local causes and providing an affordable choice of goods and services to address the needs of local people, whilst minimising our impact on the environment.

Top 3 Achievements in FY25

We are committed to engaging with and listening to our team, occupiers and communities, working together to bring about positive progress for each and addressing the issues that are important to them.

Top 3 Achievements in FY25

Being a leader in governance and disclosure means surpassing industry minimum standards and demonstrating our commitment to providing transparent, informative and accurate accounts of our ESG performance and risk management processes. We use various disclosure frameworks to ensure we align our reports with the best available guidance on the ESG issues that our stakeholders value.

Top 3 Achievements in FY25