About Us

Our Portfolio

Investors

Sustainability

Media

Our Capital Partnership portfolio focuses on four core asset types that provide affordable and well-located space for occupiers:

▪ Essential-led shopping centres

▪ Destination-led shopping centres

▪ Retail parks

▪ Regeneration opportunities

Capital Partnership assets (FY24: 23)

retail parks

shopping centres

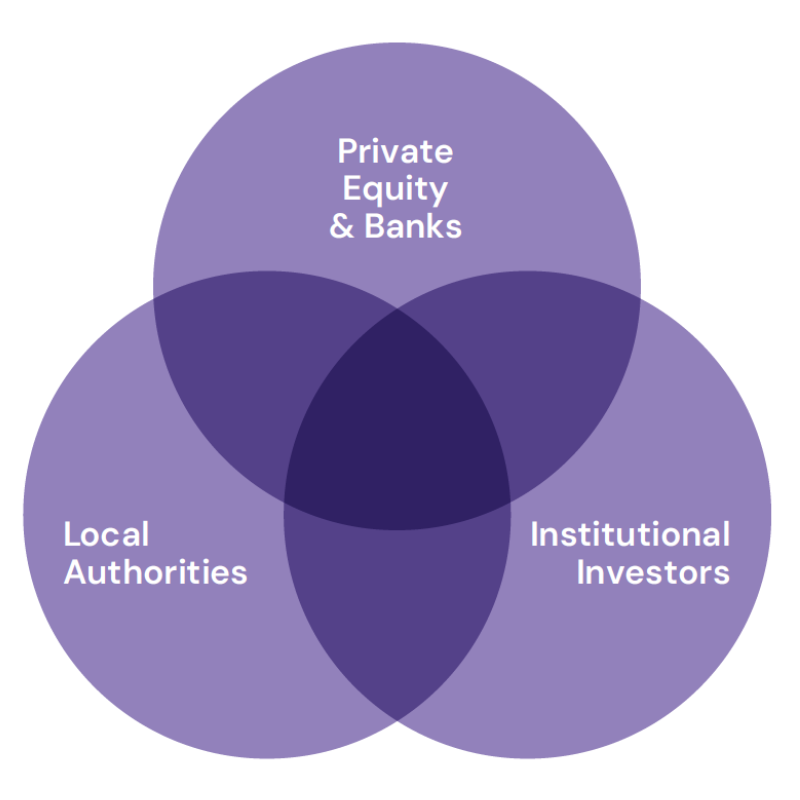

Capital Partners creating well-diversified fee income

▪ A specialist expert team

▪ An ability to co-invest as well as asset manage

▪ Data-driven, performance-focused outputs

▪ Robust operational track record

▪ Extensive sector relationships and geographical scale

▪ Town centre and regeneration master planning expertise

▪ Strong governance and ESG credentials

Delivered growth in our Capital Partnership portfolio through the acquisition of Ellandi in July 2024, expansion of existing Capital Partnerships and appointment on 2 new local authority mandates.

+16% growth vs FY24 Capital Partnerships total fee income

sq ft +135% growth vs FY24 Capital Partnerships area

+88% growth vs FY24 Capital Partnerships assets under management