About Us

Our Portfolio

Investors

Sustainability

Media

Our well-positioned portfolio is focused on providing essential goods, services and experiences to local communities.

Our assets are hand-picked to provide space for successful and growing retail and leisure operators, including those with a growing omni-channel provsion.

We provide space at affordable average rents in locations across the UK, and we now have a greater exposure to London assets.

Portfolio sales out performance vs UK benchmark (y-o-y)

Portfolio sales when accounting for online spend (y-o-y)

Valuation growth1

High occupancy

High retention rate

Occupational cost ratio

Long-term leasing transactions vs ERV

vs previous rent

Assets under management

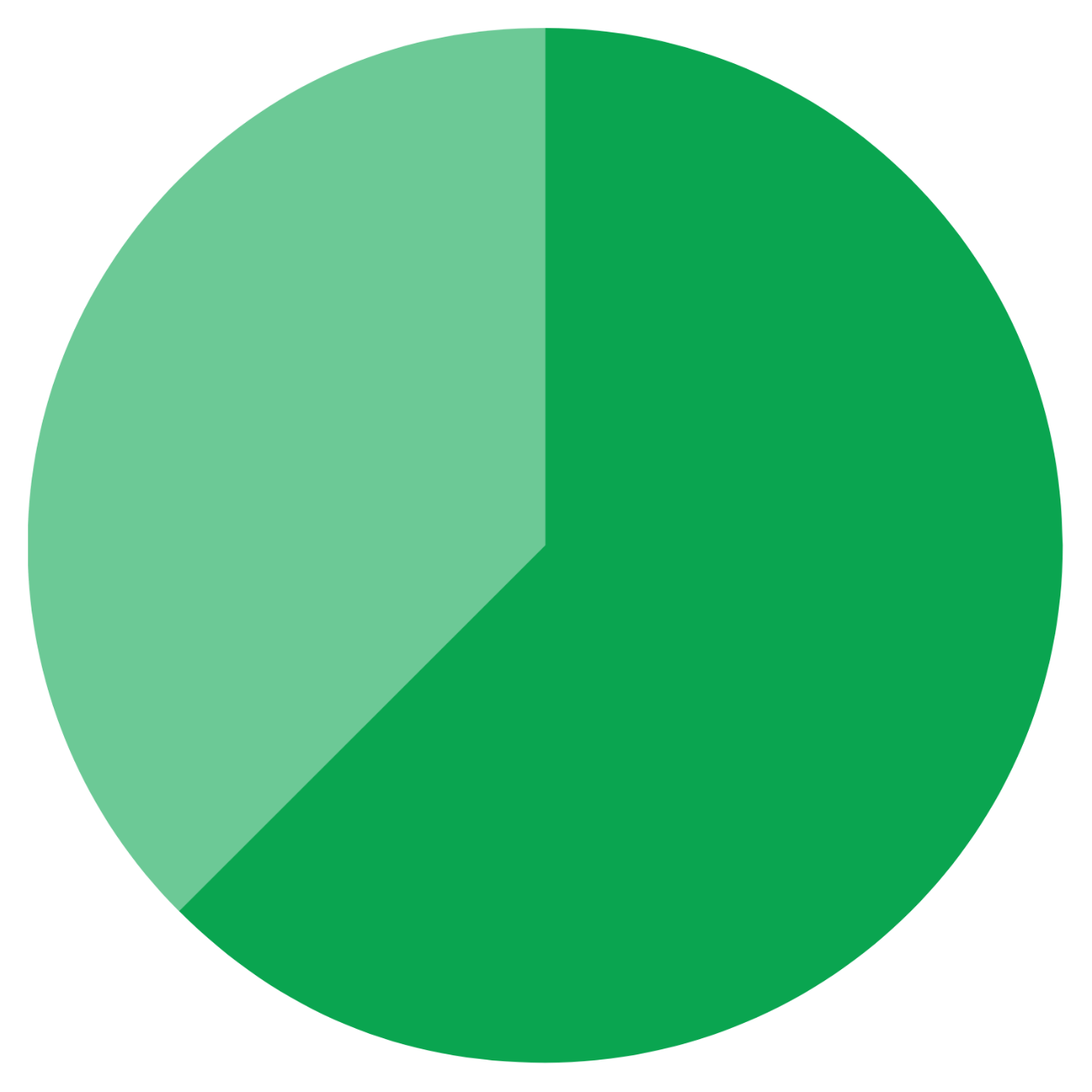

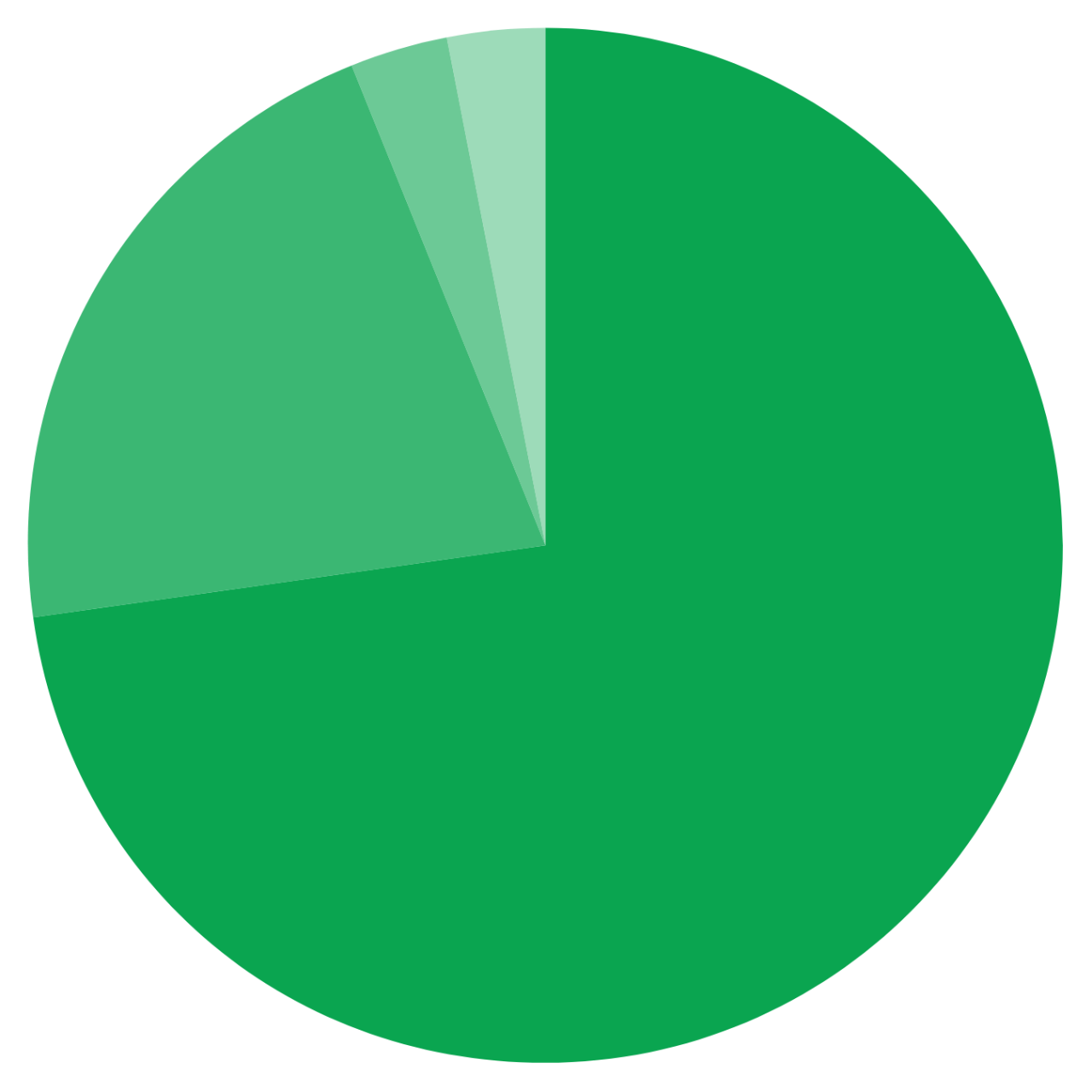

Shopping centres

Retail parks

Annual rent

Tenancies

Sq foot total area

Total assets under management

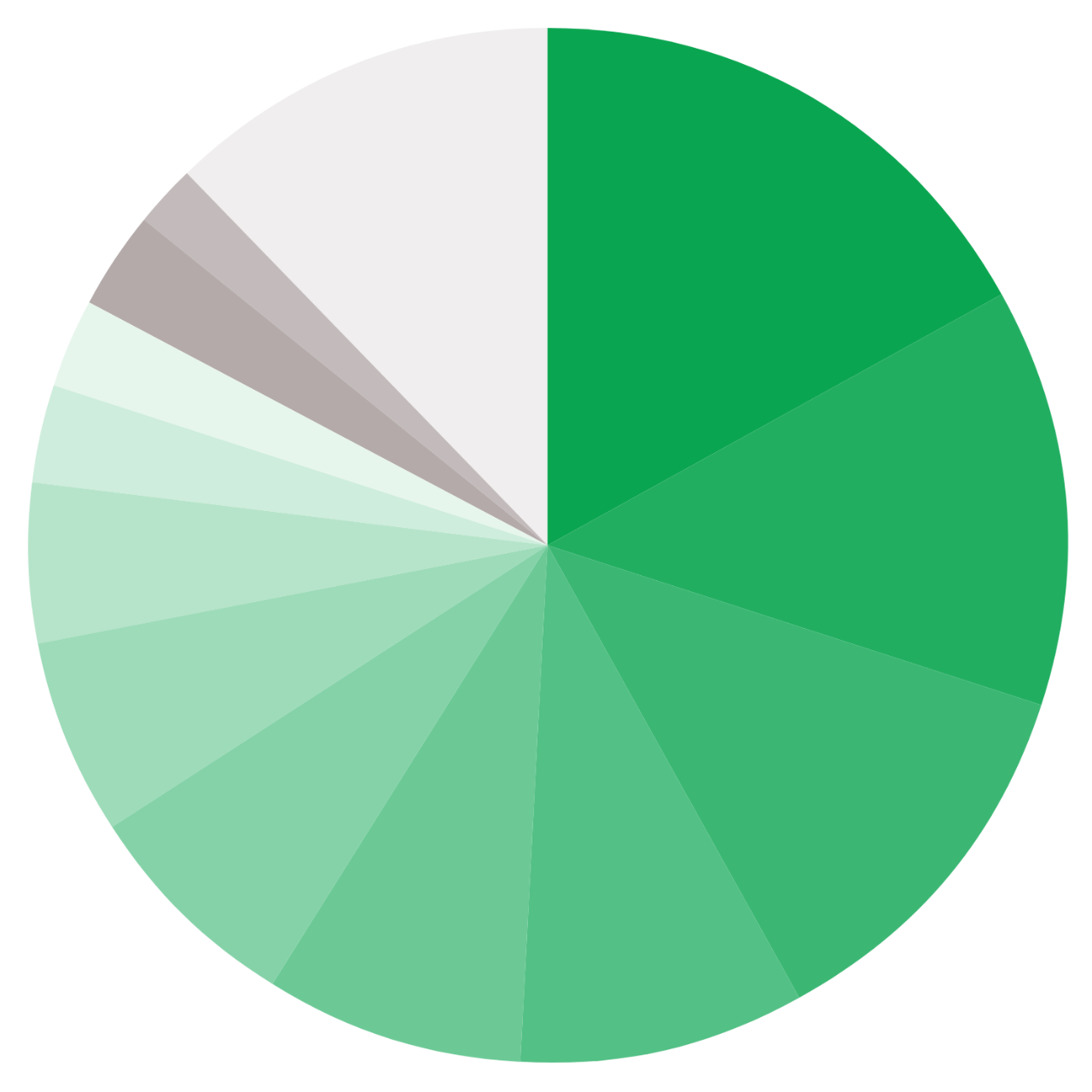

Portfolio segmentation

Sub-sector categorisation