About Us

Our Portfolio

Investors

Sustainability

Media

Retail is having a renaissance – and this Reit is taking advantage.

Retail used to be a dirty word in property but if you pick the right brands in the right location, your strategy can be on point.

Investment Risk: High

Investment Style: Value

Investment Timescale: Medium term

The shopping centre by Walthamstow tube station is far from remarkable. A standard L-shape home to shops such as Asda, Boots and Clarks, it’s a long way from the shiny Westfield-style malls favoured by many investors. Yet, when Investors’ Chronicle visited the shopping centre one Tuesday afternoon, it was also far from empty.

A humble portfolio

Shopping centres such as 17&Central in Walthamstow are at the heart of NewRiver Reit’s (NRR) strategy. The real estate investment trust (Reit) targets local shops that people might visit several times a week, rather than once a month. Proximity to shoppers is crucial here, and 54 per cent of shoppers in NewRiver premises travel less than three miles to make their purchases. More than 70 per cent travel less than five miles. Think of your local shopping centre complete with a supermarket, some clothes stores, cafés and chemists, and you have a good idea of what NewRiver’s portfolio looks like.

NewRiver bull points

What they lack in glamour, they make up for in practicality. Total in-store spend across NewRiver’s portfolio was up 5.3 per cent year on year in the three months to December. By contrast, Office for National Statistics data shows total retail sales fell by 0.8 per cent in the run-up to Christmas. The kind of shopping done in NewRiver’s portfolio appears to be tricky to cut back on.

NewRiver also has some value-added opportunities in the pipeline. At Walthamstow, expansion works are under way and the team plans to add some residential units. The Reit is also waiting for a decision on a planning application for a residential scheme at Grays in Essex, and is in “advanced legals” to deliver a mixed-use scheme at Burgess Hill in Sussex.

NewRiver does have some work to do. Revenues were down 4.2 per cent in the half-year to September 2024. However, like-for-like net rental income did increase by £0.4mn over the period and the Reit swung from a statutory £2.6mn loss to an £8.2mn profit due to “stabilised valuations”.

NewRiver is also in a decent position when it comes to debt. All of its £444mn gross debt is fixed or hedged and the average cost of debt is 3.5 per cent. The bulk of its maturities (£300mn) fall in 2028, giving it plenty of room to manoeuvre.

NewRiver bear points

Retail revival

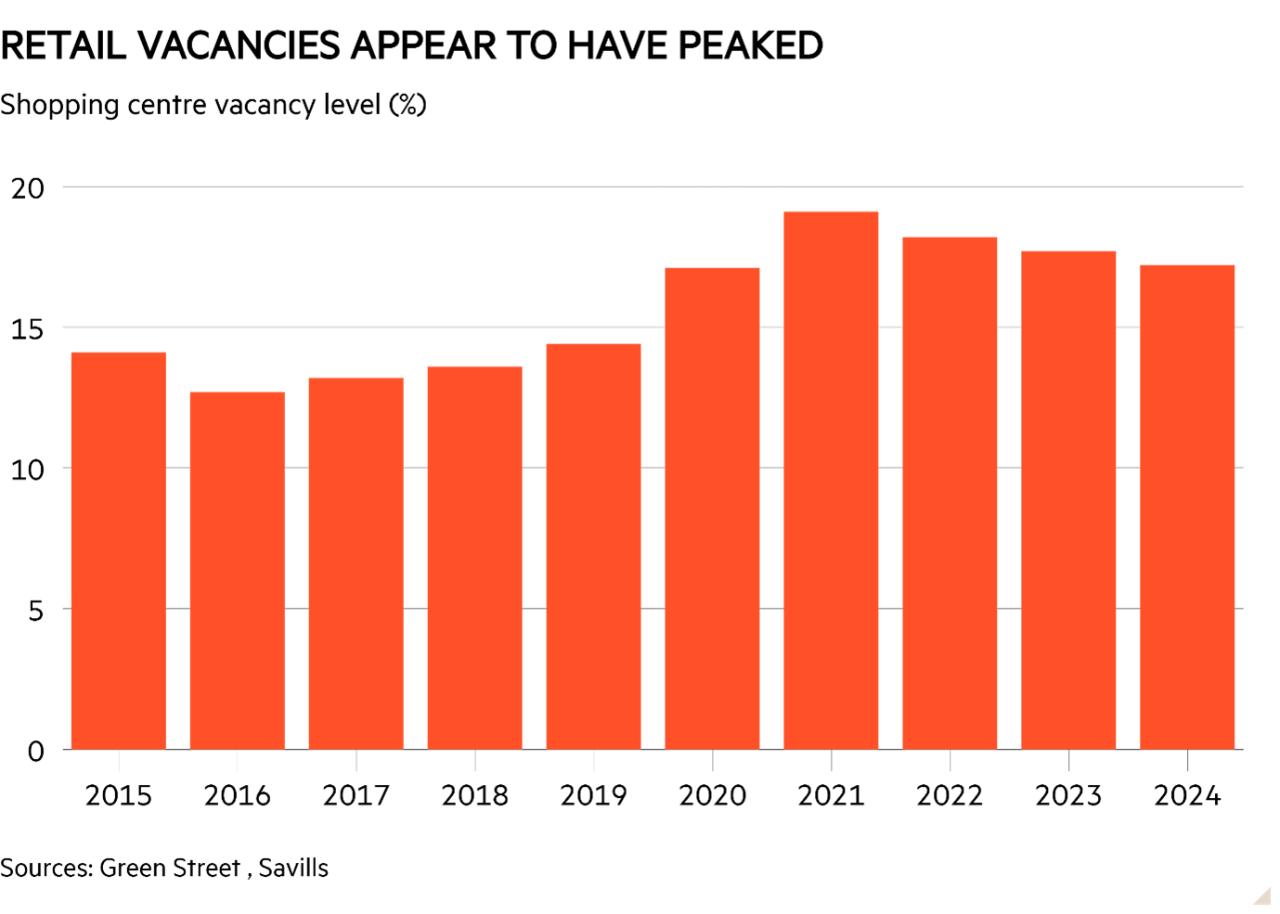

Not so long ago, retail was a dirty word in property. The rise of ecommerce and the pandemic forced shoppers on to their laptops, leaving shopping centres empty. However, this shift appears to be less linear than some thought. Both Land Securities (LAND) and British Land (BLND) are now targeting the sector.

The argument among investors is that, after several years of pain, the retail sector has finally repriced and rents are at sustainable levels for retailers again. Now they are hoping that valuations might increase.

This can be seen in the figures. Shopping centre investment volumes reached £2bn in 2024 across 48 transactions, the highest level since 2017, according to data from Savills. Yields also came down in the final quarter of 2024 to 7.75 per cent at “super prime centres”, 9.5 per cent for “prime centre” and 11 per cent for “prime centre dominant”.

Following its merger with Capital & Regional last year, 74 per cent of NewRiver’s portfolio is invested in core shopping centres and 20 per cent in retail parks. The bulk – 56 per cent – is located in the south-east and London. In other words, the majority of the portfolio is in high-yielding assets in affluent areas, both of which are good signs for growth.

A note on retail risks

Retail might be in the middle of a renaissance, but investors should still be on the lookout for risks. Tenant risk is crucial here as retailer insolvencies lead to empty spaces which, depending on the shopping centre, could take a long time to fill.

The Autumn Budget has piled on the pressure. Higher costs for retailers in the form of a higher minimum wage and bigger national insurance contributions could limit the upside for landlords as lower retailer profits could reduce their ability to raise rents. However, retailers may also be able to pass on these increases to consumers.

A NatWest report suggests that about 40 per cent of businesses will increase the prices for goods and services in response to these costs, while 22 per cent will cut spending in non-staff areas and 21 per cent will reduce or pause recruitment.

Following the merger with Capital & Regional, NewRiver’s top tenants are pretty standard. Boots is top of the list, making up 3.7 per cent of the total rent, followed by TK Maxx, B&M (BME), Poundland, Superdrug, Primark, Next (NXT), H&M (SE:HM.B), Marks and Spencer (MKS) and Iceland. In terms of measuring tenant insolvency risk, credit ratings are a good shorthand. Marks and Spencer is rated at BBB- by S&P, which is the lowest investment-grade rating. TJX (US:TJX), the parent company of TK Maxx is rated at A by S&P. Meanwhile, Next has a BBB rating.

While we do think that consumers are less likely to cut back on the kind of shopping they do in NewRiver’s centres, low consumer confidence could be a cause for concern.

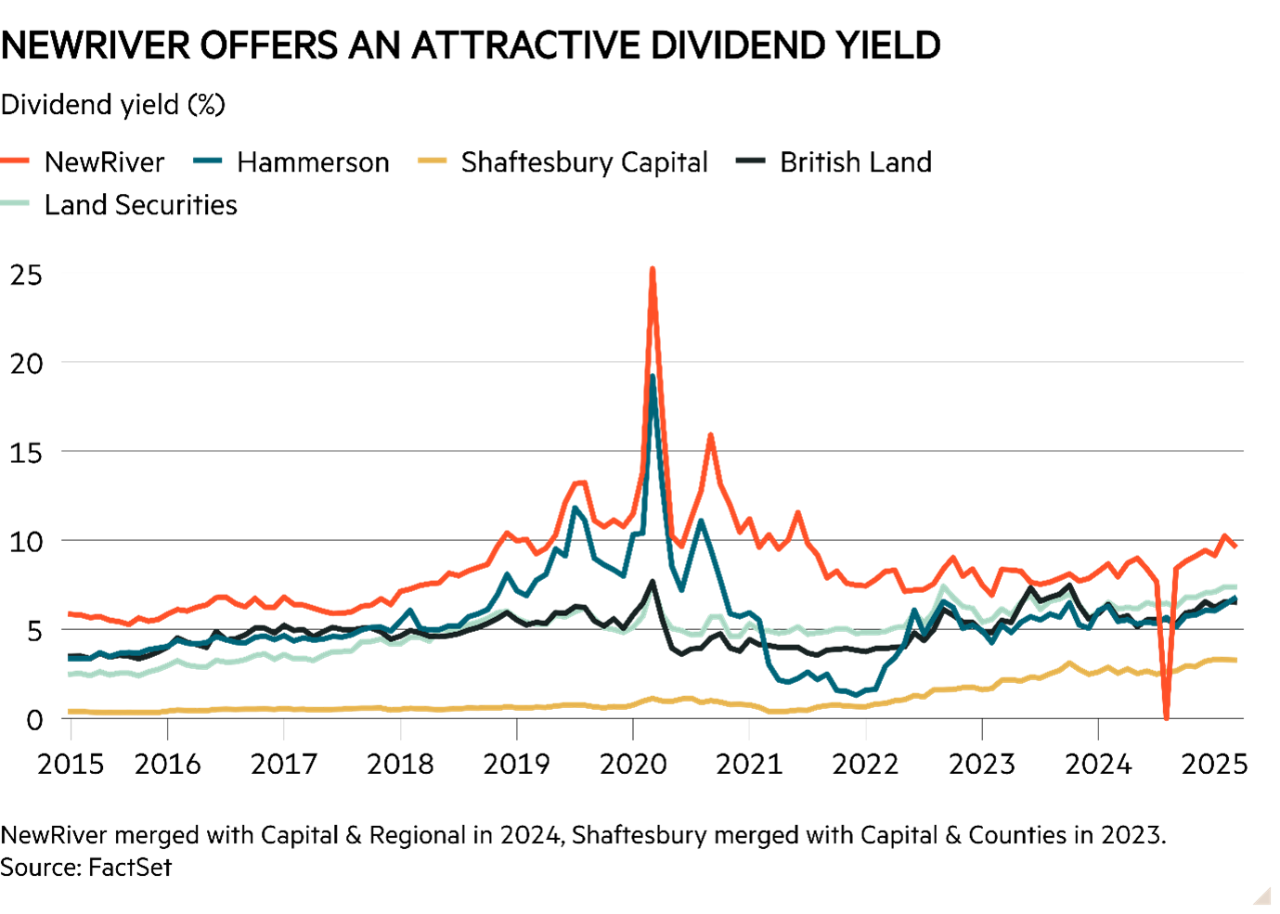

A favourable valuation

But given its strong fundamentals, NewRiver looks cheap. The stock trades at a 36 per cent discount to net asset value (NAV) and at nine times forward earnings. It also offers a dividend yield of nearly 10 per cent.

While NewRiver is the only listed player specialising in town centre shopping centres, it’s worth comparing it to other investors such as Hammerson (HMSO) and Land Securities. The latter is a diversified Reit with 12 per cent of its portfolio invested in shopping centres, while Hammerson owns flagship destinations including Brent Cross and the Bullring.

Hammerson, whose share price has been sliding after its chief executive adopted a cautious tone at results day in February, trades at a 34 per cent discount to NAV and 12 times forward earnings. It also carries a 7 per cent dividend yield. It reported flat like-for-like net rental income in 2024.

Land Securities, meanwhile, trades at a 34 per cent discount to NAV, 11 times forward earnings and has a 7 per cent dividend yield.

All of this suggests that NewRiver is cheap compared with its peers. Sure, direct comparisons are tricky, but as a final thought it is worth considering the attractiveness of NewRiver in terms of your own shopping habits. How often do you visit a shiny shopping centre such as Liverpool One, owned by Land Securities, or the Oracle Reading, owned by Hammerson? How often do you visit a fairly unglamorous shopping centre with a food shop and Boot?